Property Tax Appeal Deadlines

Why hire an attorney to appeal my taxes?

In Cook County, an attorney can file a property tax appeal before multiple forums in any given tax year; giving you more than one chance to win your appeal. A non-attorney is only able to appeal property taxes before the Cook County Assessor’s Office; the same entity that assessed your property in the first place.

“Tony saved us over $3,800 on our annual property taxes through his appeal. The process was seamless on our end, and the results were better than we expected. Worth every penny!”

– Jennifer K., Chicago Homeowner

(Google Review)

Why You Need an Attorney for Your Property Tax Appeal

Our attorney Anthony Marshiano has 25 years of real estate experience in Cook County that give him the skills necessary to assemble the best and most relevant data required in order to successfully appeal your property taxes.

To maximize savings, Marshiano Law Group, LLC appeals most clients’ assessments at both the Cook County Assessor’s office and the Cook County Board of Review. Our data shows that the Board of Review grants more—and more generous—tax reductions. But, to appeal at the Board of Review, you need to be an attorney.

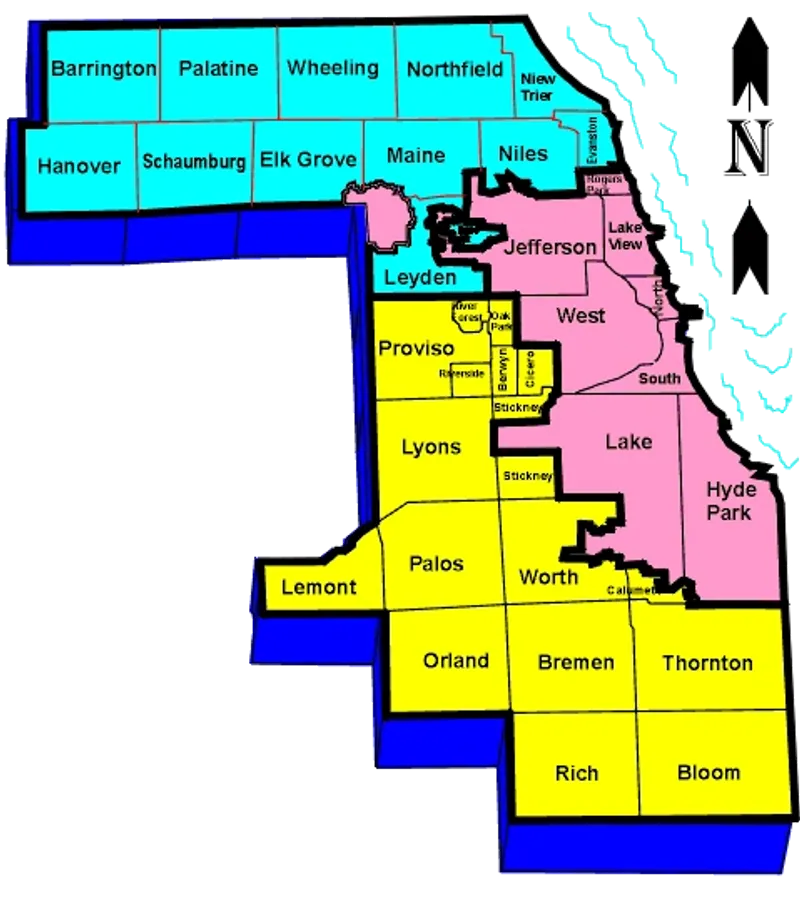

Cook County Townships

South/Southwest

Suburbs

North/Northwest

Suburbs

Chicago Townships

Lake County Filing Deadlines

Lake County Townships & Boundaries

Contact Us

Don’t overpay on your property taxes for another year. Contact Marshiano Law Group today to schedule your free property tax evaluation and learn how much you could save.

We are more than just attorneys; we’re your advocates against unfair property tax assessments throughout Chicago and Cook County.