Why A Stand-Alone Will May Not Be Enough In Illinois

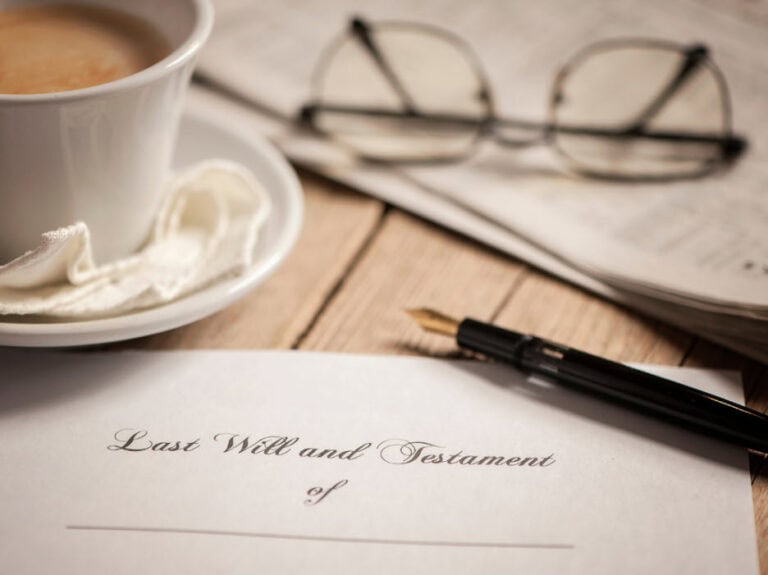

Having a will in place is one of the most direct ways to let your family know how you’d like your assets handled after you’re gone. It provides peace of mind by outlining who gets what, helping reduce confusion and friction between loved ones. In Illinois, where estate laws can trigger probate proceedings depending on asset type and value, having a will is a smart and often necessary step.

That said, relying on a stand-alone will might not cover everything you think it does. A basic will may handle who gets what, but it doesn’t always speak to things like decision making if you’re incapacitated, avoiding court proceedings, or protecting privacy. Many families are surprised to learn that without supporting legal tools, a will by itself may leave gaps that can complicate or delay the outcome they want. Let’s take a closer look at what a stand-alone will really does and what it might miss.

Understanding The Limitations Of A Stand-Alone Will

A will is a legal document that allows you to name beneficiaries for your assets and appoint someone to handle your estate. That person, typically called an executor, makes sure your instructions are followed. For many, this sounds like everything you’d need. But what a will covers and what it skips over are two different things.

Here’s what a typical stand-alone will can help you do:

– Distribute property after your death

– Name a guardian for minor children

– Appoint an executor to manage your estate

– Express basic wishes for personal belongings

Despite its role, a will is more limited than most people realize. For instance, it doesn’t avoid probate. In Illinois, even if you have a will, your estate may still go through the court system to ensure debts are settled and property is distributed legally. This can delay the process and expose private family affairs to the public record.

Another issue is incapacity. A will only takes effect once someone passes away. It doesn’t give anyone the legal right to act on your behalf if you become unconscious or mentally unable to make choices. In those situations, your loved ones may have to go to court just to get permission to handle your medical or financial matters.

Let’s say you become ill and can’t speak for yourself. Without planning tools beyond a will, your family could be left scrambling to figure out what to do. One relative may think you wouldn’t want aggressive medical treatment, while another believes you’d want every option available. That disagreement can drag out in court and be even harder to resolve in an already emotional time.

Just having a will might help your family avoid one kind of stress, but without the right set of documents in place, it can unintentionally create another. That’s why it’s worth considering tools that work together with a will to offer complete protection.

Additional Estate Planning Tools And Their Benefits

To get the full picture when planning for the future, it’s smart to use more than just a will. A few other legal tools work alongside your will to help manage health care, finances, and property more clearly and privately. These tools aren’t just for wealthy people or those with complicated situations. They’re helpful in everyday life too.

Start with a revocable living trust. This lets you move your assets into a trust while you’re still living, and you can make changes to it anytime. One major benefit is how it helps your family skip probate when the time comes. That means property and money can be passed on more quickly and with less legal red tape. It also helps keep your personal matters more private, since probate documents are public records in Illinois.

Next, consider a durable power of attorney. This document lets you choose someone to make financial choices on your behalf if you’re unable to do so. That includes managing bills, handling accounts, or dealing with insurance. Without it, your family might have to go through a court hearing just to handle basic tasks.

Another helpful piece is a health care power of attorney. It allows someone you trust to talk to doctors and make medical choices if you can’t communicate. Alongside this, a living will lets you clearly write out your wishes when it comes to end-of-life care. Both documents can reduce the stress your loved ones might feel during a medical emergency by giving them clear directions.

These tools don’t replace a will, but they fill in the parts a will doesn’t cover. Together, they help make sure your voice is heard no matter the situation.

Legal Considerations Specific To Illinois

Every state has its own laws about what happens to your property after you die, and Illinois is no exception. That’s why it’s important to understand how creating your plan here might be different from somewhere else. Rules around probate, tax thresholds, guardianship, and witnessing requirements can all vary.

For example, in Illinois, some estates can qualify for simplified probate if they fall under a certain amount, but that doesn’t apply to every situation. Even with a will, many Chicago-area families find themselves having to deal with probate if assets like real estate or high-value personal items aren’t structured properly. And Illinois law often decides who receives your property if your will isn’t valid or clear about your wishes.

Illinois also has specific rules for how many witnesses need to be present for documents like a will or power of attorney to be accepted. If you use outdated documents or don’t complete them correctly, the court might dismiss them. That can lead to delays or even result in choices being made that don’t reflect what you wanted.

The state also shapes how guardianship for minor children is handled. While your will might state who you’d like to raise them, that choice still has to be reviewed by a judge. A thoughtfully prepared estate plan can support that selection and make it easier for the court to approve.

Working with someone who understands how estate planning works under Chicago and Illinois law helps reduce risks and gives your family more clarity when it matters most.

How To Create A Comprehensive Estate Plan

Instead of relying just on a will, building a plan that covers more ground can help you avoid future problems. It means thinking through personal details ahead of time, from who should manage your accounts to how your children or pets would be cared for. Taking one step at a time can make the process easier.

Here are a few useful starting steps:

1. List what you own and what you owe. This might include homes, bank accounts, personal items, family heirlooms, and any loans or credit.

2. Decide who should receive what and think about everything that might be meaningful to you or your loved ones.

3. Choose who you trust to make medical choices and financial decisions for you if you’re ever unable to do so.

4. Plan for any kids or pets you’re responsible for. Write down who you want to step in and back that up with a good explanation.

5. Confirm and update titles and beneficiaries. Some assets pass outside a will, and having correct paperwork helps prevent roadblocks.

6. Keep everything organized, labeled, and easy to find. Check it once in a while and update after big life changes like a birth, divorce, or move.

Planning this way can cut down on stress later and help those you care about avoid confusion or delays.

Secure Your Future With Proper Will And Estate Planning

Wills are a helpful tool, but they leave out a lot. A solid estate plan means going a few steps further with things like trusts, powers of attorney, and medical directives. If you live in Chicago, Illinois, it’s especially important to use planning tools that follow local laws.

When your plan includes the right legal documents and is kept up to date, it offers clearer instructions for loved ones who may need to act on your behalf. The fewer questions they have to ask during a tough time, the better.

It’s not just about property or money. It’s about the peace of knowing that you made your wishes known and gave your family a real plan to follow.

To make sure your family isn’t left with confusion or delays, it’s a good idea to look beyond just having a will. Adding tools like a trust, power of attorney, and health care directive can give your loved ones more clarity when it matters most. Learn how thoughtful will and estate planning can help you protect what matters most with guidance from Marshiano Law Group.